From legacy to lakehouse: Centralizing insurance data with Delta Lake

CIO

APRIL 23, 2025

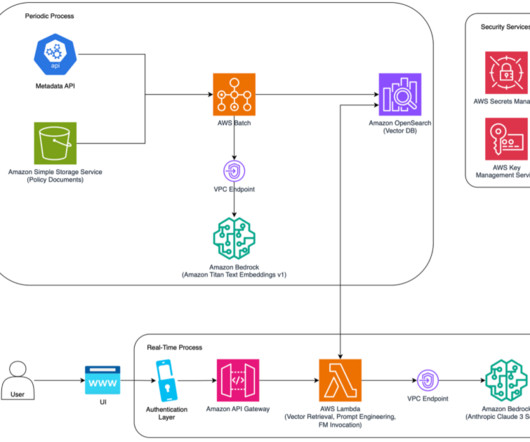

In 2025, insurers face a data deluge driven by expanding third-party integrations and partnerships. Specifically, within the insurance industry, where data is the lifeblood of innovation and operational effectiveness, embracing such a transformative approach is essential for staying agile, secure and competitive.

Let's personalize your content