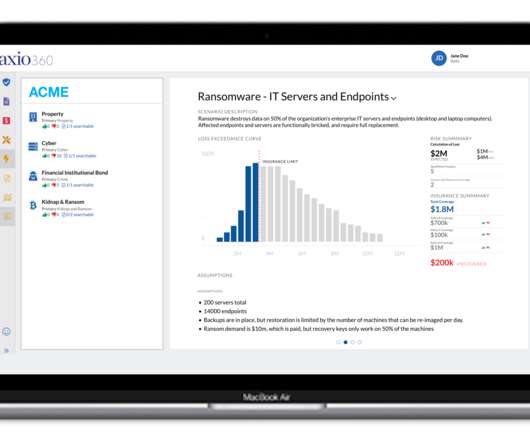

Shepherd raises $6.2M seed round to tackle the construction insurance market

TechCrunch

SEPTEMBER 2, 2021

Shepherd , an insurtech startup focused on the construction market, has closed a $6.15 But companies like Shepherd — and Blueprint Title earlier this week — are wagering on there being margin elsewhere in the insurance world to attack. Frankly, TechCrunch finds the B2B neoinsurance startup market fascinating.

Let's personalize your content