TechCrunch+ roundup: Fundraising beyond the Bay Area, web3 gaming, TDD prep checklist

TechCrunch

OCTOBER 28, 2022

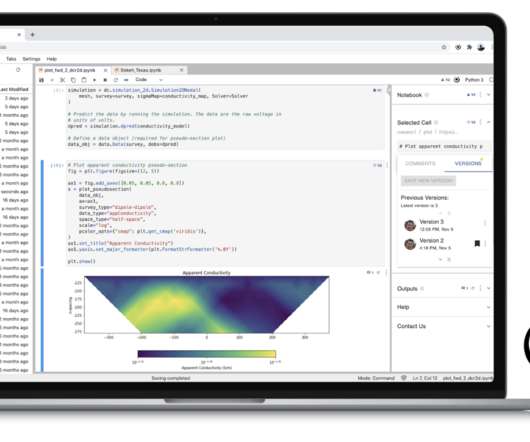

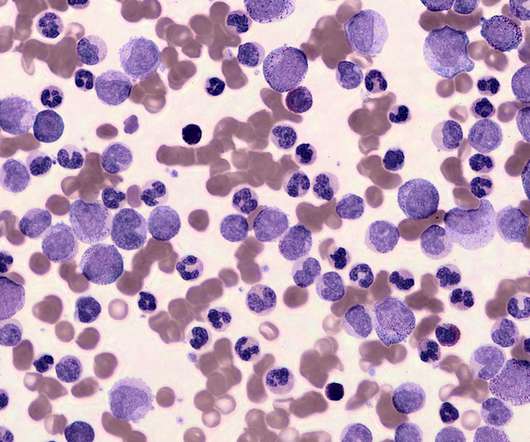

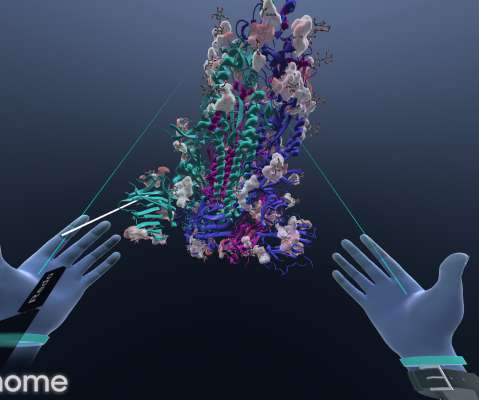

In a previous era, aspiring journalists relocated to New York, would-be actors made pilgrimages to Hollywood and plucky tech founders moved to the Bay Area so they could attract capital and talent. Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription. “We Code quality. Budding Biotech.

Let's personalize your content