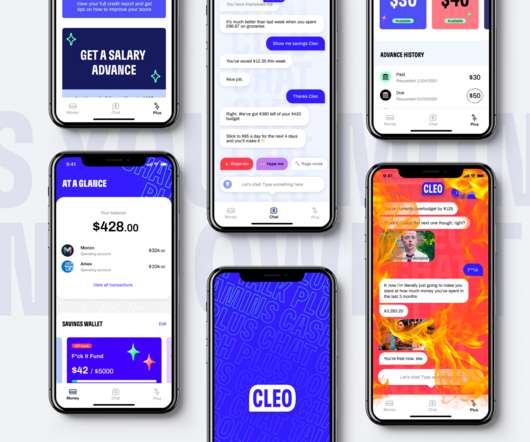

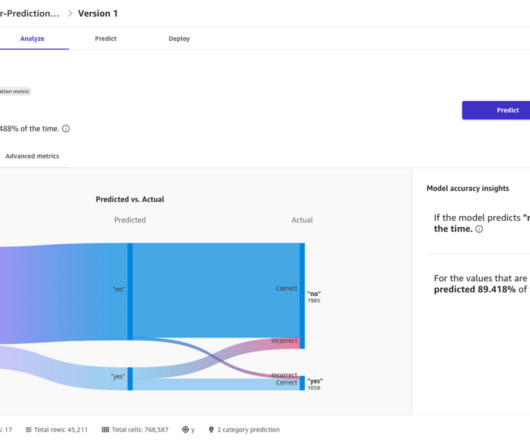

Banks bet on AI to deliver digital efficiencies

CIO

NOVEMBER 18, 2024

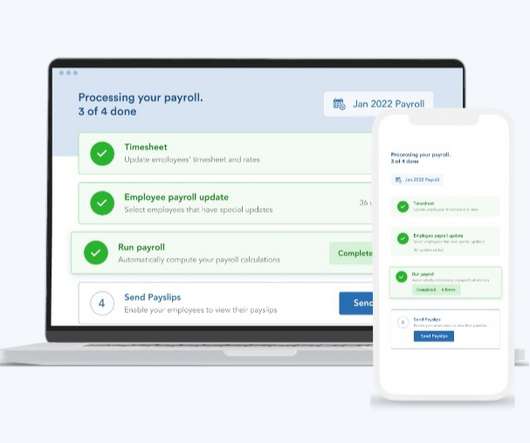

In the face of shrinking budgets and rising customer expectations, banks are increasingly relying on AI, according to a recent study by consulting firm Publicis Sapiens. Around 42% percent of banks rely on personalized customer journeys to improve the customer experience.

Let's personalize your content