FlexID gets Algorand funding to offer self-sovereign IDs to Africa’s unbanked

TechCrunch

MAY 26, 2022

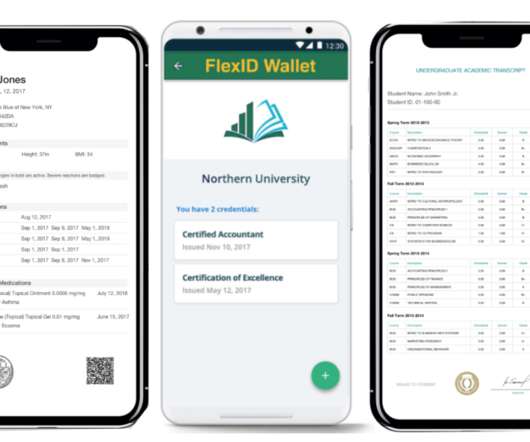

Much of the world’s attention around blockchain is on the highs and lows of cryptocurrency values. One of the startups working toward this vision is Zimbabwe’s FlexID, which is building a blockchain-based identity system for those excluded from the banking system due to their lack of identity documents.

Let's personalize your content