Israeli fintech Personetics raises $85M for tools to help incumbents personalize banking services to compete with neobanks

TechCrunch

JANUARY 19, 2022

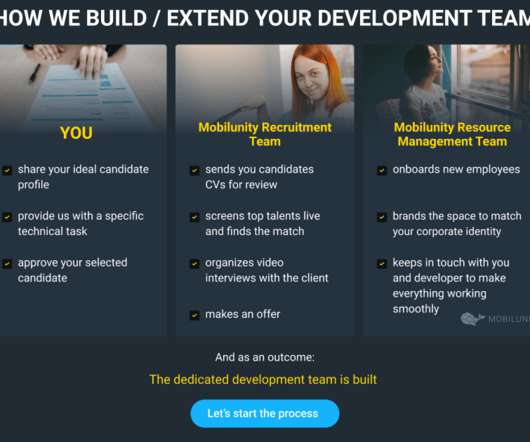

.” More commonly, they may build new services in the cloud, which they will then run in tandem with legacy services, which are not. Even in those cases, he added, “we are part of that infrastructure on services like Azure, or Google Cloud or AWS, but they own it — not us.”

Let's personalize your content