Generative AI is building the foundation of proptech’s next wave

TechCrunch

FEBRUARY 7, 2023

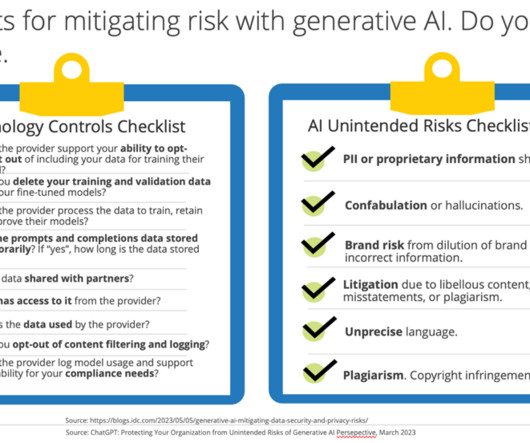

Kunal Lunawat Contributor Share on Twitter Kunal Lunawat is co-founder and managing partner of Agya Ventures , a venture capital firm focused on real estate tech, blockchain, AI and sustainability. AI’s emergence will cut through material use cases in proptech, from search and listings to mortgages, construction and sustainability.

Let's personalize your content