From legacy to lakehouse: Centralizing insurance data with Delta Lake

CIO

APRIL 23, 2025

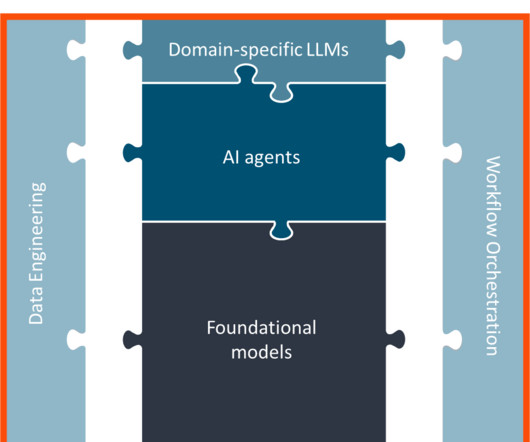

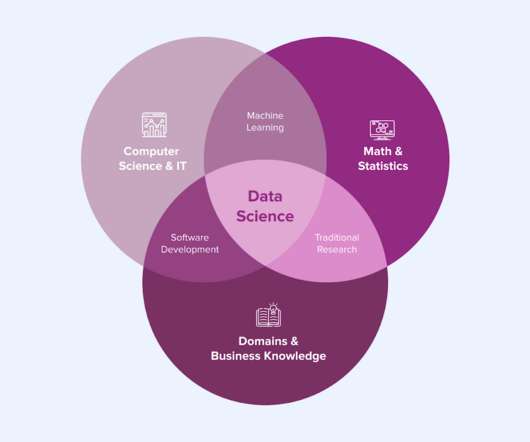

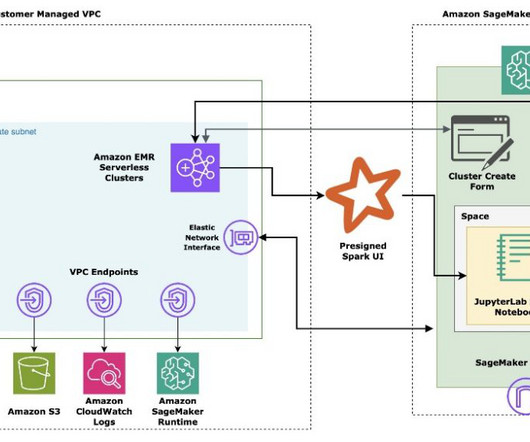

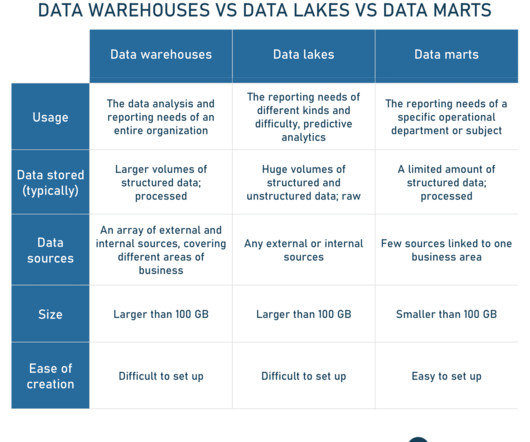

In 2025, insurers face a data deluge driven by expanding third-party integrations and partnerships. Many still rely on legacy platforms , such as on-premises warehouses or siloed data systems. Step 1: Data ingestion Identify your data sources. First, list out all the insurance data sources.

Let's personalize your content