African tech took center stage in 2021

TechCrunch

DECEMBER 30, 2021

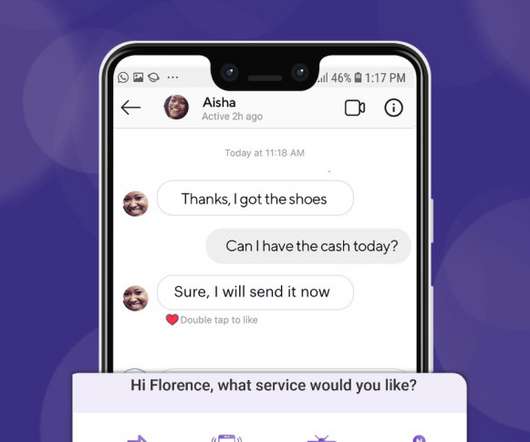

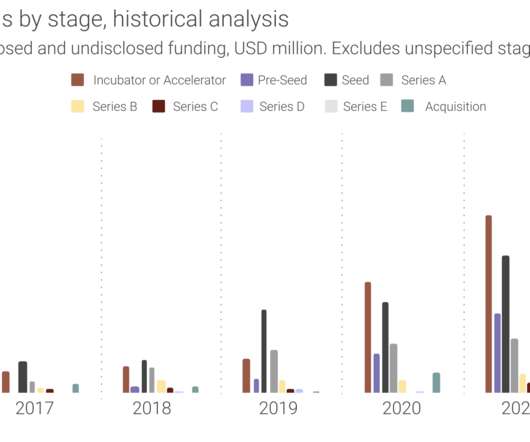

Two years ago, the African tech ecosystem saw newfound attention from global players that translated to the continent’s best year of receiving venture capital. From varying sources, it is estimated up to $2 billion went into African tech startups in 2019. It wasn’t a bad year, though. African startups nearly raised $1.5

Let's personalize your content