UK pension startup Smart banks $95M

TechCrunch

MAY 15, 2023

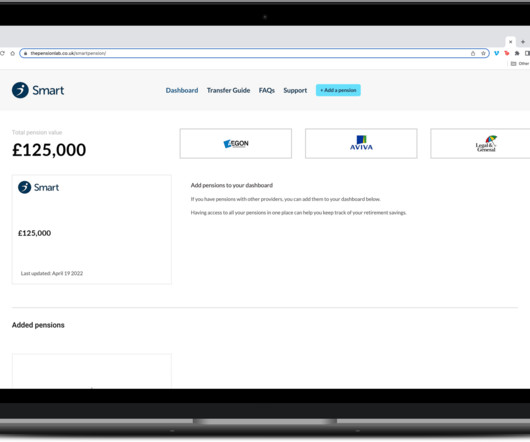

Founded out of London in 2014, Smart emerged in the wake of the U.K. Smart does this via a retirement savings technology platform that it has built, called Keystone. UK pension startup Smart banks $95M by Paul Sawers originally published on TechCrunch

Let's personalize your content