Compass files S-1, reveals $3.7B in revenue on net loss of $270M

TechCrunch

MARCH 1, 2021

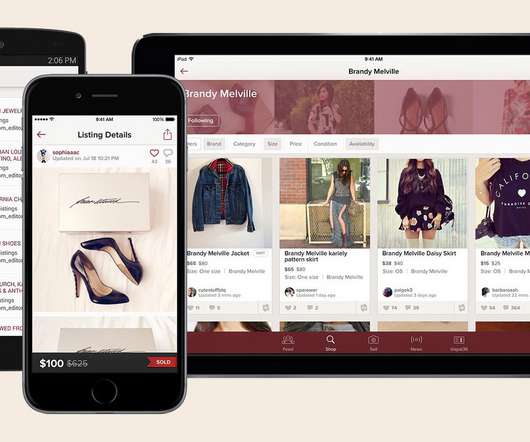

The company’s last fundraise was in July 2019, when Compass — a company that has built a three-sided marketplace for the real estate industry, along with a wide set of algorithms to help make it work — raised a $370 million round of funding. The company’s revenues have increased from $186.8 million in 2016 to a whopping $3.7

Let's personalize your content